What are

/r/CreditCards'

favorite Products & Services?

From 3.5 billion Reddit comments

The most popular Products mentioned in /r/CreditCards:

The most popular Services mentioned in /r/CreditCards:

Privacy.com

Schwab

Hotels.com

Spotify

Entropay

You Need A Budget

Dynalist

Lifehacker

KAYAK

Google Flights

GrubHub

Matrix (airfare search)

Wise

Amazon Pay

Simple

The most popular Android Apps mentioned in /r/CreditCards:

Compare Credit Cards by Silver

Boost for reddit

The most popular VPNs mentioned in /r/CreditCards:

The most popular reviews in /r/CreditCards:

You can still sign up. Just say you have an iphone, fill out the app in a web browser, at the end, there's a QR code to download the android app. Worked just fine for me.

Edit: Here's the Android App URL https://play.google.com/store/apps/details?id=co.x1.x1card

$13 wallet from Amazon, has easy access to two most often used cards on outside, otherwise basic black leather bifold, no logo

Personally I would use the Schwab debit card. Zero liability due to Schwab's policy.

When we went to Europe (about two years ago) we would use the Schwab card to withdraw cash at ATMs. We'd do a withdrawal about once a day so that we weren't carrying around too much cash. But I'm sure you can use the card at restaurants and POSes fine.

Have you tried applying for a Capital One card? Capital One cards have no FTFs.

Whatever you do, though, I would tell the bank that you are going to Greece for the period of time (typically this can be done online).

I’ve had a Bellroy for over 7 years now. Love it.

Bellroy Card Sleeve (Premium Leather Card Holder or Minimalist Wallet, Holds 2-8 Cards or Business Cards, Folded Note Storage) - {{colour} https://www.amazon.com/dp/B00D8MP6WY/ref=cm_sw_r_cp_api_glt_fabc_W0TRJR3EF11NXQZN1STD?_encoding=UTF8&psc=1

Basically I used a VPN (Private Internet Access), and connected to their server in Tokyo so it looked like I was in Japan. Went onto Delta’s website, searched a random flight from JFK to NYC, picked a random seat, and then at the bottom of the checkout page is where they try and offer you one of their cards, and it had the 90k + $200 + Waived AF offer. I disconnected the VPN (to prevent any fraud detection of why I was trying to open up a credit card in Japan), then clicked on the offer link, went to the Amex page where i confirmed the offer was sticking, then applied. And since I’m already a Amex customer it was a soft pull.

Does Wells Fargo also plan to discontinue the co-branded Hotels.com card?

Based on previous Wells Fargo announcements, I would guess they'll also keep the Hotels.com card.

Works fine with Hilton that was a FHR for me. I recently booked/stayed at a Hilton property through AmexTravel which was a FHR property since I wanted to use my $200 FHR credit. On my booking it asked for my Hilton#, I got my gold status and upgrade. Didn't get any points for the stay but I rather have the FHR benefits ($100 hotel credit + $30 per person daily meal credit)

But ya, I agree if it wasn't part of FHR I would just book directly. For the non big commercial hotel brands, I have used AmexTravel instead of like hotels.com, some properties they have a "lowest price guarantee" and I would email them another OTA and they priced matched without any issues.

Ah ok, thanks. Not familiar with them beyond it is frequently used for sending people money internationally. Tho it does look like that was very likely the cause of your cash advance.

They mention it as one of their FAQ. They say they use MCCs for a Wire or Money Order.

https://wise.com/help/articles/2977994/why-was-i-charged-extra

With more places accepting Apple Pay, I’ve only needed to carry my license and one catch-all card for those not accepting digital payments, so I’ve been using this iPhone case/card holder. It says it holds 2 cards, but I can comfortably fit my license + 2 cards https://www.amazon.com/dp/B07SZJKW4C/

Following on jx288’s comment, the Amex Plat via Resy, their restaurant reservation service, which is offering 125K points after $6K spend in first 6 months, but most importantly in your case, 15x at small businesses and restaurants on up to $25K spend for the first 6 months. If you can max that out, you’ll earn 500K points. There is a Shop Small searchable database on Amex’ website, so you can see if the company(ies) where you’ll be making your purchase(s) is listed, but I’ve read that it’s not comprehensive (ie, some companies that aren’t registered also qualify). If you want cash back, you could apply for the Schwab Platinum, together with the Resy offer or by itself, which is offering a slightly lower SUB (100K) and spending multiplier (10x) with otherwise similar terms, but does allow you to cash out your points for 1.1 cents each. You do, however, need to have or open a Schwab investment account, so it’s a little more complicated, but if you were able to max out both, you’d be looking at a massive haul of points. Good luck.

Some banks are touchier than others. Get a card from a different bank. You should really have more than one card anyways, in case the first one gets locked or lost.

> international withdraw fees for my bank are pretty high.

You should not be paying ATM fees at all, anywhere, ever. Many banks/credit unions refund ATM fees in the US, but some also refund them globally. One popular choice is Schwab Investor Checking. No fees or minimums, no foreign transaction fees, and they refund ATM fees globally. To open the checking account you have to open a brokerage account, which is also free and has no minimums. The downside is that their interest rate sucks (0.03% at the moment, lol).

By comparison Alliant is 0.25%, no fees, but they only refund $20/month in ATM fees, and have a foreign transaction fee.

IMO credit cards have three major advantages:

- cash back / points (I find cash back a lot simpler)

- if there's fraud you're not out any money while they're investigating

- building credit history

- (and your specific card may have other benefits... yours looks like it has a $20 statement credit for good grades and maybe identity theft protection. Other common benefits are extending return windows, trip/travel insurance, extended warranties, etc.)

Their major disadvantage is that credit cards let you get into debt and have high interest rates. If (and only if) you're confident you'll never spend any more than you'll be able to pay back at the end of the billing period, then credit cards are great to use for everything.

If you don't think that's possible, a secured credit card (Discover has one with cash back) is sort of in between and has its own pros and cons.

Charles Schwab has a debit card with no ATM fees anywhere in the world and foreign transaction fee, so that's the only debit card I carry around with me and I only use it when I can't use my credit card.

If you’re paying last month’s expenses with this month’s income, do you really have that money in the bank? Aren’t you waiting to get paid before you can pay off the card?

https://www.youneedabudget.com/are-you-riding-the-credit-card-float/

thanks. yeah clean history. short (9 months secured and 10ish months w/ 2 regular CC), but clean with no problems so far. basically similar card to blue cash everyday with no fee etc: https://www.schwab.com/public/schwab/investing/accounts_products/credit_cards

Only way to get 10x is to prepay hotel with cash. Not a fan at all.

I have historically made all my hotel bookings with just a credit card on file, either directly with hotel brand or through Hotels.com with Free cancellation, and I don't pay a penny until I check in. Mind you, using TopCashBack or Rakuten can still get you 4-7% cash back booking this way.

Looks like there’s an answer on Amazon for a question about the dimensions

https://www.amazon.com/dp/B0776WX577/ref=cm_sw_r_cp_api_glt_fabc_17Z4AEJK2598A3MGK3JM?psc=1

Not sure how well it lines up with what you ended up getting

I bought a Travelambo last year for $10. It is real leather. They say it is RFID blocking at 13.56MHz (credit cards), but not 125KHz (ID badges & building access cards). I've tried a few minimalist wallets, and this is the best I found so far. Travelambo Minimalist

I got this recently, and it's working well enough so far. Every page is "slit" at the rings, so you can easily re-order them. OTOH, that also means they could slip off a ring if you're flipping too aggressively.

I've got 12 pages full (36 cards), and a handful of business cards in another section. It's still thinner at the edge than the spine, so I know I can fill a few more pages before it gets too full.

I don't have 36 active cards, but I've put some cards from older, closed accounts in it that I'd been hanging onto, as well as "membership" style cards that I don't need to carry, since I use the app, or look up by my phone number. Keeping them in here will help me keep from losing them.

The nice thing about a paged organizer like this, is if you wanted to scan all your cards for record keeping (in case of theft, or fire destroying it), having the cards laid out in the pages would make that process much less tedious.

This one is great.i don’t carry it around. I just use it for storing cards. Big Skinny Leather Traveler Slim Wallet, Holds Up to 20 Cards and 4 Passports, Black https://www.amazon.com/dp/B006O1Z4OQ/ref=cm_sw_r_sms_c_api_i_wgeHCbVZ2DA04

Since they are all essentially a copy of the original Ridge wallet, just search ridge wallet on Amazon and a lot of options will come up. I bought this one over two years ago and have not had any issues with it: Wallet

​

There are cheaper ones than that so I am not 100% sure why I chose that one over others. This one is about half the price of the Rossum (different money clip): Wallet

​

The nice part about all of them is they are much cheaper than the original Ridge one. You could buy 3-4 of them and swap them out depending on your mood or style of clothing that day if you are into that sort of thing.

This is the Amazon link showing $200 (will open in app: https://www.amazon.com/dp/BT00LN946S/?plattr=PP1

The chase site still shows $150: https://creditcards.chase.com/cash-back-credit-cards/amazon-prime-rewards

I use an Android app called MaxRewards which advises me which card to use at a particular merchant based on the cards I have told the app that I have and the merchant category. It tells you the merchant category when you search for the merchant but I'm not sure where it gets the info. They want you to link to your financial institution to sync your data but I didn't do that.

I use a “156” card organizer for any cards I’m not carrying in my wallet. Cut the number in half and that’s realistic since it is intended for 2 business cards per slot and I’d only put 1 credit card since I don’t want to stretch it or anything.

Wenger Luggage Diplomat https://www.amazon.com/dp/B00GKC4R56

I keep the card info in a secure password program on my phone/computer.

This is what I use.. I put my ID and license on the insert wallet, can also put 3 more cards on there. When I go out I just need a debit card, a credit card ,my IDs and public transit card, I take the wallet insert and leave the rest of my wallet at home with my cards. It has 8 card inserts. Ive had this for almost 4 years and will definitively buy another one

I use this to carry 3 cards + IDs + cash.

Dopp brand. I like the leather.

Yep, launched Android in January! The new For You and store database for Pointers will be in the next big app update for Android along with as many of the new features of v4 as Android can support (plus a few goodies that iOS doesn't have -- both apps are fully native and build to each platform's strengths):

https://play.google.com/store/apps/details?id=com.cardpointers.app

It isn't a wallet, but I bought this faux leather business card holder for your exact same reason. It's been perfect.

Look on Amazon for a business card holder. There are tons of options.

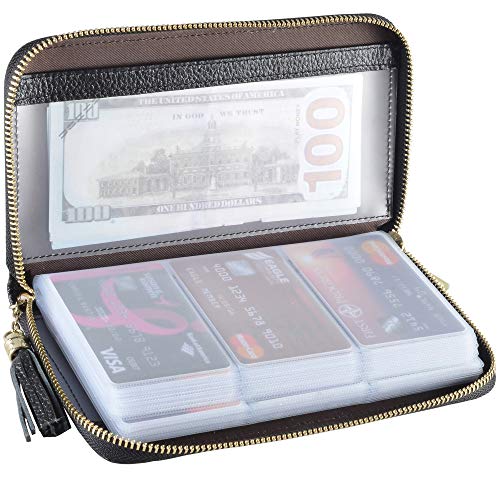

Personally I use something like this, but there are tons of different styles. https://www.amazon.com/Credit-Holder-Leather-Business-Organizer/dp/B082DYGG9Q/

I use the Butterfly Wallet, which is the smallest, thinnest wallet available that can hold 12 cards and any size currency. It's really an incredible, but simple design.

https://www.amazon.com/gp/product/B003EM8BE8

https://urbanultralight.com/product/butterfly-wallet

It looks like:

Primary: https://smile.amazon.com/gp/product/B07937FQF9/ref=ppx_yo_dt_b_search_asin_title?ie=UTF8&th=1 - I've noticed it can cause cards to collect dust at the parts that stick above the slot, but no real damage that I can tell, cards expire before any damage becomes noticeable.

One I just picked up a few days ago but haven't used yet: https://smile.amazon.com/gp/product/B01IEEJX3S/ref=ppx_yo_dt_b_search_asin_title?ie=UTF8&psc=1

Obviously wallets aren't something I prioritize other than "does this hold as much as I need it to?"

I buy one of these then get a new one every other year (lasts 2 years). I always have a spare. I can hold all my cards and an insurance card in the center. It also has RFID protection. I consider it my anti bouji wallet as its pure function and replaceable.

Because I'm constantly losing my wallet and wasting time looking for it, I ended up getting an AirTag wallet like this one on Amazon. It's been a literal time saver and it's pretty slim, though the letter does feel a bit cheap.

Or, you know, instead of damaging your card you could have bought any of the hundreds of RFID / NFC blocking sleeves. You'll want them when you upgrade your drivers license to a ReadID one which includes an RFID chip. Keep people from scanning you at a distance.

> I could just get a free trial though, right? Regardless, when I look on Amazon it says $60 not $200, even for prime members.

If you can get prime, even through a trial, you can get the $200 sub. Also where are you looking? I just google quickly to see and I can see the $200 sub offer.

https://www.amazon.com/Amazon-Prime-Rewards-Visa-Signature-Card/dp/BT00LN946S

You have to apply for the black card not the blue card.

> In theory, sure, but I'm just wondering if it would be better to go SUB + cashback (regardless of which cashback card I get) instead of 2x SUB, since I won't be applying for another credit card for like a year or two.

The Chase Sapphire Preferred is also a cash back card as well. It pays out in points but can be redeemed just like a cash back card. After one year you can product change it into a Chase Freedom, Freedom Flex, or Freedom Unlimited. All three cards are useful cash back cards too.

Re-reading your post I see that you have a Discover It Miles card. Call up discover to see if you can product change that card into a regular Discover It card. Last I heard Discover is temporarily not doing product changes for some reason, but that was 2 months ago. See if you can product change that miles card into a more useful card.

>I remember seeing your original reddit post a few weeks ago! Glad you got approved for the nice bonus the Citi Premier offers.

Thanks!

>If you click this link you should see $200 bonus on Amazon card. https://www.amazon.com/Amazon-Rewards-Visa-Signature-Card/dp/B007URFTYI

Unfortunately that says $50 for me for some reason.

>If you're considering the Citi Double you might as well keep the Venture X instead for 2X back with good travel points. But I think the Citi Custom or Discover is a good fit if youre looking for simple rewards.

You're right. The VX is iffy for me because of the steep annual fee, but I suppose it's worth it for now, especially since I don't currently own a car so I'll occasionally spend on rental and get nice bonuses.

I remember seeing your original reddit post a few weeks ago! Glad you got approved for the nice bonus the Citi Premier offers.

If you click this link you should see $200 bonus on Amazon card. https://www.amazon.com/Amazon-Rewards-Visa-Signature-Card/dp/B007URFTYI

If you're considering the Citi Double you might as well look at the Venture X instead for 2X back with good travel points. But I think the Citi Custom or Discover is a good fit if youre looking for simple rewards

There are a ton of no name brand versions of it but I saw that Wenger made one and I know they do make pretty decent stuff so I chose theirs instead. I figured there was too much of a chance of most of the no name brand versions being made out of plastic that would crack and tear apart in a short time for not much less money.

Wenger Luggage Diplomat “156 card” https://www.amazon.com/dp/B00GKC4R56

SavorOne - 3% on groceries, restaurants, streaming

Citi Custom Cash - 5% on the category you spend most in the billing cycle up to $500 spend

Chase Freedome Flex - 3% Restaurants and Drugstores, 5% Rotating Category

I love my phone wallet because I hate having to remember multiple things when I leave anywhere. There were literally zero wallet cards when I bought my 12 Max Pro so I got this

Case-Mate - Tough Leather Wallet Folio - Case for iPhone 12 Pro Max (5G) - Holds 4 Cards + Cash - 6.7 Inch - Black https://www.amazon.com/dp/B08FY5LZ9V/ref=cm_sw_r_cp_api_i_923NJX50F9EXE2B7MJEM?_encoding=UTF8&psc=1

My only gripe is there’s no locking mechanism. I have five credit cards, insurance card in the top slot, one in the middle, one in the bottom and then ID. So total of 8 credit cards but I can definitely fit more.

I’ve actually been looking to move to a card wallet lately and have been checking out the Ekster Parliament, Dango D01, Fidelo card wallet, Frenchie speed wallet, Nomad just came out with a good offering etc

I use a knock off ekster, still works just like the original one but a fraction of the price

Mens MINIMALIST Slim Wallet, Modern | RFID Blocking With Card Pouch - Black https://www.amazon.com/dp/B09Y3W96HW/ref=cm_sw_r_cp_api_i_220H6T93KBADPV1Z4VBT

Can hold 10 cards plus I.D, bought it late 2020 still has hold up well

Zitahli Money Clip Wallet-Mens Wallets slim Front Pocket RFID Blocking Card Holder Minimalist Mini Bifold Smart Design https://www.amazon.com/dp/B08CXZQC5C/ref=cm_sw_r_cp_api_i_CFASRCE787C7D8XD1GRZ?_encoding=UTF8&psc=1

Slim Wallet Vintage Genuine Leather Card Holder Minimalist RFID Blocking Credit Card Case for Men and Women by Bigardini (Khaki) https://www.amazon.com/dp/B091CX13KN/ref=cm_sw_r_apan_i_MR5DQSPSP6FS71C9G40A?_encoding=UTF8&psc=1

I use a business card binder from Amazon like this one

Sooez Leather Business Card Book Holder, Professional Business Cards Book Organizer PU Name Card Credit Cards Book Holder Booklet (Mint Green) https://www.amazon.com/dp/B07Y8PKP5D/ref=cm_sw_r_cp_api_i_52W32MEBZ9V3MGPXCGBZ?_encoding=UTF8&psc=1

Get Freedome Flex instead, if you’re pre approved with those too most likely you’re good with CFF too. They’re alternating 5% categories never clash with Discover IT and you can make more money back. CFU 1.5% doesn’t do it for me and the sign up bonus isn’t impressive. Actually I think CFF is running a $300 SUB and 5% gas for a year.

> Any suggestions on the best SUB to look into to help with airline?

Maybe look for a high bonus on a United card? The Explorer Card has a decent offer. They are a transfer partner of Chase Ultimate Rewards and offer flights to Paris from Newark round trip for 65,000 + $85

If you’re planning to keep your Sapphire Reserve though, it could be a similar value to book a nonstop on your airline of choice through Chase Travel due to the special rate with that card.

> Is there a usual time of year when SUBs peak?

US Credit Card Guide keeps track of historical offers:

Due to your Sapphire Reserve with the special points value, you may also want to consider comparing French hotels in the Paris Rick Steves Book with before transferring or booking with an American chain like Hyatt.

Slim Wallet Vintage Genuine Leather Card Holder Minimalist RFID Blocking Credit Card Case for Men and Women by Bigardini (Khaki) https://www.amazon.com/dp/B091CX13KN/ref=cm_sw_r_apan_i_ZNSJQ9A3KZ5T9KEMPTFE?_encoding=UTF8&psc=1

There’s a really great book called “The Anatomy of the Swipe” that breaks down what happens when you use your card to pay for something. Where the data goes, who gets paid for what (and how much). It’s short and has some pictures to help explain. Super helpful.

The Anatomy of the Swipe: Making Money Move

https://www.amazon.com/dp/1641374470/ref=cm_sw_r_cp_api_i_ZWMCJNVFW8GA8BEXQMYR

Just as an FYI - Amazon's "Auto-Reload" that you set on a schedule is a minimum of $5 increments, but you can do manual reloads for as low as 50 cents. It's a bit more work since you have to do it manually, but I just get in the habit of reloading once per week for a total of $2/month. It takes no more than 30 seconds each time.

I've been using this simple amazon one for months. I can put 9 into in, but I only carry 7 personally. AMEX, CSR, CIU, CIC, 2 IDs, Debit Card

This is the one I use the most. I like to have a lot of card options (and some cash) too and mobile pay isn't really a big thing in my area.

I use a bi-fold wallet, this one.

For awhile, I was using one of those ultra-slim ones (like ridge wallet etc) with a little switch to pull up the cards...but I had problems with it.

- The cards sometimes seemed to fall out or come loose. Which I felt was like one slip and me not noticing away from losing a card.

- It was hard to manage my cards and pull out the one I want. I carry like 3-4 cards at once.

SO I ended up just going back to a regular ol'bi-folding wallet because of it.

I got a really cheap ultra thin wallet off of Amazon that I have 7 cards and my driver’s license in at the moment. I could probably get one more in there if I wanted to.

Slim Minimalist Front Pocket Wallet, Ecovision RFID Blocking Credit Card Holder Wallet with Detachable D-Shackle for Men Women https://smile.amazon.com/dp/B08QRX9T9T/ref=cm_sw_r_cp_api_i_GJSZ2SN9GBZQ19S250B0?_encoding=UTF8&psc=1

I use this wallet from Amazon for about a year now and it works for me each sleeve can hold a card and the very middle made for cash that I never care can hold 2-3 cards it works perfect for my 4 CC setup and I always carry a my discover cash back debit incase a place is debit only or chases high fees for a CC

Here's the spreadsheet I put together recently!

​

I also keep a written list in my iPhone notes app:

- Restaurants & Supermarkets - Amex Gold

- Airfare - Amex Gold

- Expensive Purchases - Amex Gold

- Car Rentals - Amex Gold

- Intl. Spend - Amex Gold or Point

​

- Rideshare - Point

- Subscriptions - Point

- Verizon - Point

- Amazon - Point (Temp)

- Italic - Point (Temp)

- ATMs - Point or Charles Schwab

​

- Apple - Apple or Amex Gold

​

- Everything Else - Citi Double Cash

Thanks, so it sounds like I can use the app to get a account/routing number for ACH and not use it after that.

I use Android and in the Play Store, the app has a rating of 3.1 stars and lots of people are complaining about it. You can see the reviews here https://play.google.com/store/apps/details?id=com.biltrewards.bilt&hl=en_US&gl=US . I'm not sure if the iOS app, it may be better.

On Amazon. I think you have to be signed in, but on this website it should say “See if you’re pre-approved” below the Apply button

I love this wallet easily adapts to my usage. RFID Carbon Fiber Wallets for Men - Minimalist Aluminum Wallet for Men - Money Clip Wallet Metal - Mens Wallet Slim Card Holder https://www.amazon.com/dp/B08J49MB2R/ref=cm_sw_r_apan_i_R4EXDJKA8B5V9ZS4H146?_encoding=UTF8&psc=1

This is an incredible thread. It really shows the vast difference in lives people on this sub live. There is everything in here from designer leather wallets costing hundreds of dollars to <$5 AliExpress knockoffs. Magpul dakas to ewallets. I don't know why I'm getting such a kick out of this.

After going through a half dozen different wallet designs I eventually settled on the maxpidition micro wallet. which comfortably holds 8 cards for me plus my Id. I will probably thin out the herd a bit once I hit some SUBs though.

Same brand but a slightly different model... hinged money clip is built into the fold/spine and it doesn't affect anything. And there's a little pullout tag on the side, pop out your ID card or your favorite cards rly quick. Love it Amazon

This front pocket, slim wallet from amz. Mens Money Clip Wallet - Teisson Slim Bifold RFID Blocking Genuine Leather Minimalist Front Pocket Card Wallet for Mens (California Desert) https://www.amazon.com/dp/B07X7Z819G/ref=cm_sw_r_apan_glt_i_CNFCQ5J82ZYWGQFZWRT2?_encoding=UTF8&psc=1

I use the following, -amex gold -Amex platinum -truist enjoy cash -discover it -chase freedom unlimited -amex BCP -PENFED cash rewards -Lowes card

Plus my drivers license, cc license, costco card AND I have space for cash in the middle. Love this wallet

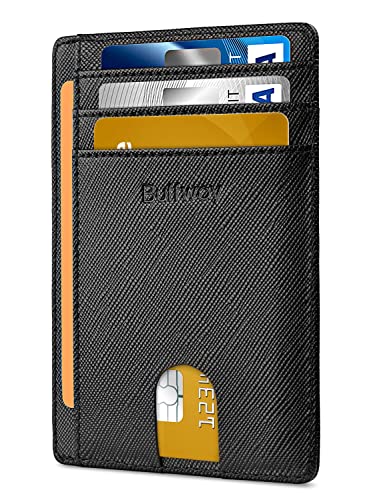

Buffway Slim Minimalist Front Pocket RFID Blocking Leather Wallets for Men Women https://www.amazon.com/dp/B079DCW7GB/ref=cm_sw_r_apan_glt_i_JTNRXVM25QW9D1MD3YSS?_encoding=UTF8&psc=1

Bellroy Note Wallet (Slim Leather Bifold Design, RFID Blocking, Holds 4-11 Cards, Coin Pouch, Flat Note Section) https://www.amazon.com/dp/B0973TWQ4R/ref=cm_sw_r_apan_glt_i_Q054TMFPQWR4SCRMTGJR?psc=1

- Amex Plat - No need to carry it around. Stick it in a 2nd wallet for when you travel.

- Amex Green - OK to carry around (but what do you use it for??)

- Amex BBP - OK to carry around (but what do you use it for??)

- Cap One Savor - OK to carry around

- Cap One Venture X - OK to carry around, but it seems like it can go in your phone easier.

I use Nomatic basics, two of them. One for everyday, other I throw in when I'm traveling to hold airline cards and priority pass.

For all my sock drawer cards I have a business card holder like this

I actually use this manhattan portage coin purse from Amazon.

Quite comfortable in the pocket and as I have anywhere from 20-30 cards in my wallet at any given time it does a great job.

Also hols receipts, coins, keys, flash drives. Really whatever random thing I need to keep secure usually fits.

I actually just went down the rabbit hole of wallet reviews recently. Spent way too much time looking at all the Eksters, Secrids, Bellroys, Ridge, Trayvax, Amazon knockoffs, etc. Fully prepared to spend $100 on a nice wallet, what do I land on? An ugly, probably Amazon-drop-shipped, $10 zip-up accordion wallet with several card slots (like this one or this one).

But I carry more cards than necessary. If you minimize your carry, there are definitely some sleeker, better looking options. This wallet just satisfies my criteria:

- Quick access to cards without having to shuffle through them or wiggle them in and out of a tight pocket.

- Keeps cards separate so they’re not rubbing together.

- Cards won’t fall out if I drop the wallet.

- Cards are fully covered so their corners/edges don’t wear out.

- Smaller footprint than a typical bifold (fits in front pocket but is admittedly less sleek than more minimal card holders).

- And as a bonus it’s super cheap, so if I get more than 1 year of durability that’s pretty good

Bought it on sale for like $80. Everyone should have something similar in their car. Also makes inflating bike tires a breeze.

I whittled it down to just a few cards which makes it much easier to manage.

Recurring bills are either CFU or CIC to get 1.5% or 5%, CIC for 2% on gas, amex gold for 4x restaurants/groceries.

April was my first full month on YNAB when you're setting it up there's an option for "pay card in full" or "pay overtime" the former will do the math for you and reassign the funds from a budget category to the correct card payment fund- this way you should have the cash to make the payment.

I feel like this gives me a big picture view and I don't feel like I need to pay them off weekly, bc I know the money is going to be there.

Redeeming points for Ultimate Rewards is a ripoff. It doesn't show the best flights and the price is always jacked up.

Your best bet is transferring the points to a partner airline at 1:1 and redeeming them their. WAYYYYY better value IMO. It looks like you already booked it though. It may be worth the ground work to see what the difference is in points by booking with Ultimate Rewards vs directly with United. It's possible with Covid shit you could cancel with Chase, get your points back, transfer points to United, then book with United.

If you want to get an idea of just how bad the Ultimate rewards is for redeeming rewards, type in a random search for a fictitious vacation. Head over to Google's ITA Matrix and search for the same exact dates. You'll be surprised! Find one you like on the ITA Matrix? Transfer your points to that carrier's frequent flyer program if possible.

Remember that you cannot transfer Chase points to Delta, but you can transfer them to Flying Blue, a partner with Delta and sometimes get domestic or other Delta flights through Flying Blue.

Yes CC sometimes renew but sometimes dont. For example Cap One had a deal with hotels.com with the original venture but hotels.com decided to release there own card and Cap one stopped the relationship and made there own portal later. My guess would be they renew the deal to compete with AMEX uber but anything is possible.

Yeah I hope the WF rumors are true about some new cards soon. They have a lite lineup currently and really the cobranded hotels.com card is about the only one at present offered.

And once you loop in the Chase portal, there are trade offs vs direct booking (hotel/rental car pts/status and shopping portal stacking) and vs other portal options like hotels.com that provide their own rewards which may be better or worse than the +7UR benefit on the CSR.

>or even plans that USED to be student but are no longer.

Actually no. That is incorrect. In the T&C of gift card it says this:

>Gift Cards, eGift Cards and other currency-denominated Cards cannot be redeemed for discounted or group subscriptions ([...]offers combining Premium with other companies' products or services).

The reason why you can't use gift cards is because you have a bundle subscription with Hulu, not because it used to be a student subscription.

Gift cards T&C: https://www.spotify.com/us/legal/gift-card/

If at all you have any problem with PayPal and end up getting a collection notice, immediately file an id theft report with FTC site and use that to file a CFPB report on their site.

Collection scavangers will back off immediately as long as PayPal knows it's a legitimate hack.

Also, this means that password is breached, change the password in all places and try to set unique passwords (I know it's easier to say than follow).

Also breach lookup: Search by email: https://haveibeenpwned.com

Search by pwd: https://haveibeenpwned.com/Passwords

Credit Karma also does a good job of alerting if your data is found in a breach.

rfid chips can be scanned within about 3 feet. https://www.amazon.com/Blocking-Fuss-Free-Protection-Contactless-Protector/dp/B07SHTQ4X4

Stick that in your wallet, get whatever color is cheapest, there is zero difference. It essentially makes a dummy activation jamming signal for RFID when a scanner powers up the chip in it, blocking reading of all near by cards. You can test it, stick it next to a tap to pay card in grocery and it wont tap to pay anymore.

Skimming has moved into the wireless era with near field technology.

I have this one. Can't recommend it enough.

Minimalist Wallet for Men, ARW Metal Money Clip Wallet, RFID Blocking Aluminum Slim Cash Credit Card Holder (Carbon Fiber) https://www.amazon.com/dp/B07C1N6L2D/ref=cm_sw_r_apan_glt_i_JB17MTHEQWKHESJVZ0JS

ngl, i thought the whole rfid thing was just a buzz word thrown around as a marketing thing. i use a backpack with my cards loose (yes i know this is stupid) and have never had an issue

i like the way these two look tho

but im personally looking for something more feminine

Oh well, Im pretty you sure you just need A Schwab account for something. I personally have a Schwab Brokerage account (normal investing), a Roth IRA (retirement), but you can also get Checking accounts, other retirement account types, etc.

https://www.schwab.com/public/schwab/investing/accounts_products/accounts/open_an_account.html

I would hold off if you haven’t applied yet. Upon reading their guide to benefits I can see that their price protection does not cover online advertisements, that’s a dealbreaker for me right there. Plus you have to physically mail your documents to them, there is no method of submitting electronically.

If you’re a Schwab Cilent, their Schwab Amex investor card can also give you 1.5% back in any of your investment accounts. Which you could turn into buying more company stock.

https://www.schwab.com/public/schwab/investing/accounts_products/credit_cards

Currently 7 but only really use 6. I plan to make a simpler combination at some point and add another travel card to replace current one then downgrade it to a cash back card.

Current:

1) Costco Visa (will keep even if just for 4% gas spend in future).

2) WF Active cash (will keep for 2% non category spend).

3) WF Propel (will keep. I use for 3% back travel, also use for amex offers that it gets along with WF "earn more mall" offers. This card is free and easily pays for itself with just promos even if I get a better travel card).

4) AMEX BCE for 3% not including promo (may keep if for no other reason then the offers netted me almost $200 this year on a no fee card). I may go BCP in future if I dont keep. ALT PLAN: BCP

5) Chase Freedom Visa (will keep as is free 5% back category card and works as multiplyer to Sapphire so effectively 6.25% back).

6) Chase Sapphire Preferred (may keep or may try alt travel card). I use for rental car, and will use hotel credit so it effectively pays for itself. I use for all dining spend which effectively is 3.85% back. ALT PLAN: US BANK ALTITUDE RESERVE if I can get it.

7) Capone quicksilver (wont keep, Its actually a downgraded Venture after I used up the huge 75K SUB and the hotels.com 10X offer expired). I have it just covering a few streaming services through amazon that are $5 a month total. Its not competitive so at some point I will get rid of, its only 3 year HX in total.

​

ALT PLANS: US bank Altitude reserve could actually replace my Sapphire Preferred, My BCE (because 4.5% back > 3% back grocery and I can pay using Mobil wallet) and most of the non gas COSTCO card function. In theory I could eliminate: BCE, Sapphire Preferred, Quicksilver, and actually the costco card too and replace with one card which would earn more overall and has a SUB I have not had ever.

Oh, I see. Unfortunately, I've already received my $300 by using the Cap1 portal, so I can't test this out.

Anyone can still use the Hopper app to compare prices, and then decide. To my surprise, I was able to book a hotel cheaper via Cap1 travel portal than Hotels.com or Expedia.com and through the portal you also get a 10% back in miles and can apply them to your account within days of the purchase.

>Flight prices mean nothing without the details.

Hence my original statement. I can find you $4000 flights during that time too.

> If you want to go to asia from the east coast, it's pretty cheap. If you want to go to a specific location at a specific time from a specific place, it's much more expensive.

BOS > YYZ > PVG, 2 hour layover in YYZ for $390.

My email says by 9/30/2020. Maybe there's a newer email with a more recent offer?

Edit: https://www.spotify.com/us/claim/chase/

It says so right here too.

If you've done a trial of Premium before it says you are ineligible but based on my records I did a trial in 2015 and I was still able to use it so YMMV in that regard.

Same error. Various browsers, computers, same result, over course of 2 months.

Support unable to help, going through the standard troubleshooting script (try incognito session/another browser/another computer; the only slightly unusual part was question about using a VPN; but VPN or not made no difference); finally on the 3rd call support staff admitted there is a known issue with VAN cards, no ETA to resolve.

privacy.com virtual cards work, but it's a debit card (proxying to checking or debit card account).

Hopefully KlutchCard would release their virtual credit card; they've wound down their debit card offering.

I agree, besides Flash, the very short time-to-live of the cards made their usefulness much less for me. But the web app has been updated and now has a 2 year max that you can default to for new cards! MUCH more interesting for me to start using again.

Of course, during this time of their Flash app and TTL being so short, I starting moving toward Privacy.com, which still is annoying that it doesn't offer a credit card (you have to generate VANs against a debit account), so now I have to decide if I want to migrate back over to Citi over time.

I'm in the process of getting set up with Privacy.com so I don't have direct experience with them yet. But some of the cons that I've identified and am willing to live with:

- You're using a virtual debit card linked to your checking account (either by logging in or using your main debit card). This means no getting points that come with your credit cards. (I thought about using a Capital One credit card that has disposable CC numbers as a feature of the card instead.)

- You can have one funding source per Bank.

- You can't mix and match Debit funding sources with bank log-in funding sources.

- Not all banks are supported. (One I wanted to use wasn't supported.)

There may be others. That said, I'd much rather use a disposable debit card number for one-off purchases where I'm concerned about the security of my info. I especially like their ability to lock numbers to a Vendor if you want to keep a number open (not just one-time use) such as for recurring payments.

privacy.com virtual cards have similar protections as a credit card. Once I had an issue with a $250 charge, I emailed the support explaining the issue and got the refund within 3 days.

>I know that it only creates card aliases for a debit card or bank account--not a credit card--so does it also carry the same problems as a regular debit card if fraud occurs?

You're still using your debit card to pay, so any fraud at the card level is going to be handled the same way by the bank. Using Privacy.com may or may not reduce the likelihood of such fraud occurring in the first place (as you're storing information about your card in one place instead of many), but it won't change your legal protections.

>I was curious to see if anyone knew how a company like https://privacy.com/ generated their virtual cards. Do they have a partnership with Visa, Chase, a different bank?

>

>Essentially, I am trying to find out what the process would be for getting a partnership to generate unlimited virtual cards for users on a platform that would link their bank accounts via https://plaid.com/.

This is so helpful, tysm!

So to be clear, you think our best bet at getting a partnership to generate VCC is through Plaid/SoFi type enterprises?

This or something like it: https://www.amazon.com/gp/product/B081TY93HB

Hear me out.

- $9 or less on amazon.

- Lasts a year or two (mine is on its second year) then you chuck it and get another for less then fastfood.

- Blocks RFID.

- Holds 7 cards easily + drivers license (it has a center pocket you cant see in pics which could do 2 cards for a total of 8)

- Very thin and fits in front jeans pocket without any hassle.

- If you get sick of the color, literally take out cards and order a different one at that price.

Nice, Amazon used to do a physical card for the $99 for 1 year of premium, it is nice that it is an e-gift card now.

Here is the link is anyone was looking for it: https://www.amazon.com/Spotify-Premium-Month-Subscription-Gift/dp/B09MWM6TS1

There is a point at which you will get a code from FICO stating that you have too many revolving accounts. I believe I got that reason a few years ago when I had a ton of accounts. I later cleaned house. I think that the number of revolvers that can give you a negative reason code is somewhere around 20. See this article from Experian:

"https://www.amazon.com/dp/B01N4KNOTM?psc=1&ref=ppx_yo2_dt_b_product_details

​

"Credit Score Risk Factors Can Help You Understand What Is Affecting Your Report

If you are considering closing accounts because you feel like the number of credit cards you have open could be hurting your scores, think about ordering a copy of your credit score before making any changes.

When you receive your credit score, you should also receive a list of risk factors that will describe what elements in your credit report are negatively affecting your score.

If one of the factors listed is "too many open revolving accounts," then you may want to consider closing one or two. However, if the number of open revolving accounts is not listed as a factor, then you probably don't need to be concerned with the ones you already have."

Minor quibble, but it's $250k to get the $100 off.

https://www.schwab.com/public/schwab/investing/accounts_products/credit_cards

https://www.schwab.com/public/schwab/investing/accounts_products/credit_cards

Like a regular amex platinum but allows you to cash out MR points at 1.25x 1cpp, i.e. the 60,000 SUB is worth $750. Open a free Schwab brokerage account, apply, then transfer that money from MR points to any bank account.

If you're okay to use a debit card rather than credit card, Schwab offers a great chip+pin one along with their checking account (no monthly fee, no minm balance requirements). You can use the card globally with zero foreign transaction fee.

https://www.schwab.com/public/schwab/banking_lending/checking_account

Japan is a very cash-centered economy, and it's really safe there, don't need to worry about pickpockets. I'd recommend opening a Charles Schwab Investory Checking account, it's served me well in Japan and around the world. It has no foreign transaction fees, and will refund any ATM fees. Since 7-11s are like Starbucks in Japan, one on every street corner, I just went to the ATM in there to withdraw my spending money to use.

keep you current card untouched. you can go with the charles schwab platnium amex, you can get 60k points for signing up, cash those out to a schab account for $750, earn 5 points for every dollar spent on flights booked directly with the airlines, and 5 points for every dollar spent booking hotels directly through the amex portal. then you can cash out points at 1.25 cents a piece to your schwab account i believe it is.

you could couple this with the gold card and earn 4 points per dollar on dining and other cats.

there are annual fees involved, but with your monthly spend even if you only use a portion of the direct cash perks like the $15 a month uber credit, and the $200 airline incidental credit per year, you'll still come out way ahead. something to think about.

https://www.schwab.com/public/schwab/investing/accounts_products/credit_cards

I have an AMEX Gold Card, so the likelihood of me being qualified for the 100k offer is slim to none.

Seems like Charles Schwab is having a targetted 100k offer at the moment so I can see if I might qualify for that.

I got the gold card because I wasn't targetted for the 100k platinum, and I spend significant amount dining out and on groceries and wanted to not let the money go to waste.